Construction contract awards provide relief in the wake of ISG collapse

- Large spike in contract awards driven by major infrastructure projects suggests negative effects of ISG collapse are still to come

- Residential development is on the rise but still falls way short of housing targets

- Infrastructure saw the largest gain in planning approvals with an increase of 136%

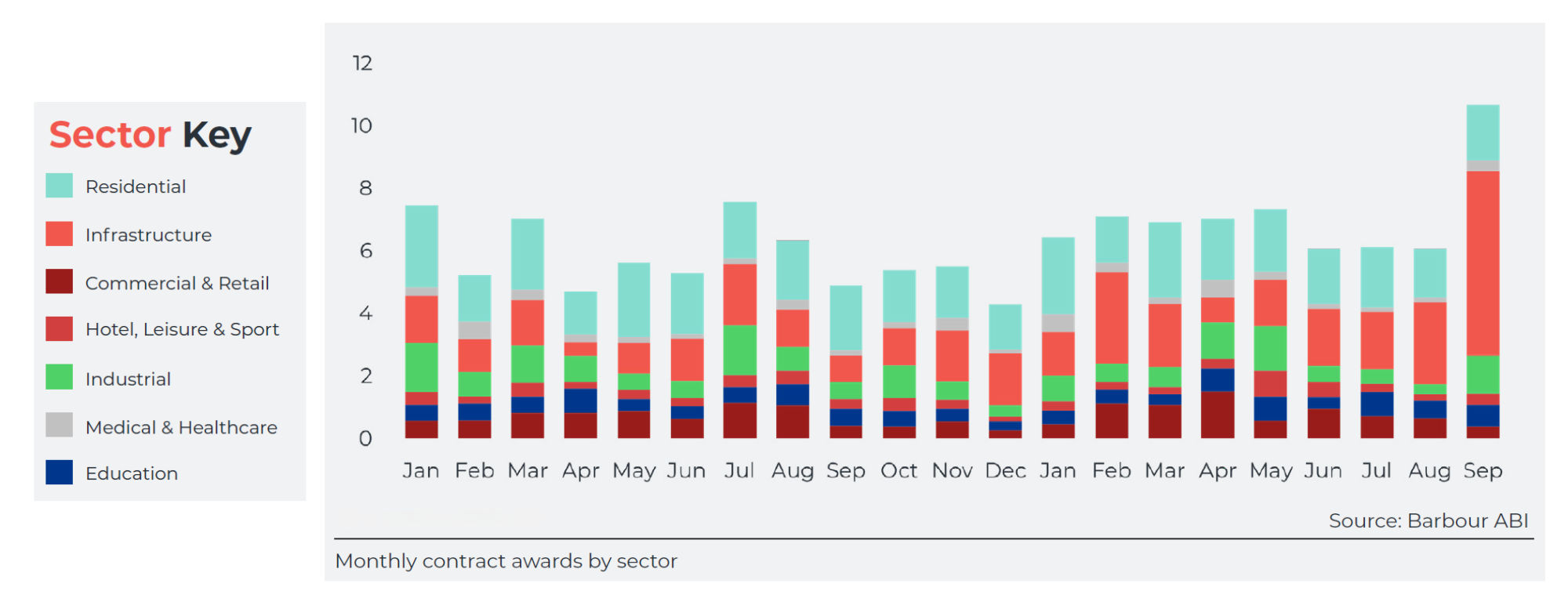

Contracts awarded for construction projects in the UK were up 76% to £10.7bn in September, thanks to two large infrastructure projects in the form of the Hornsea Offshore Wind Farm (£3.6bn) and the East Birmingham to Solihull Metro Extension (£735m).

Without these major projects, contract awards remain roughly in line with previous months, according to analysis by Barbour ABI. This shows that the impact of ISG’s collapse in September has yet to fully impact the sector.

The industrial sector, where much of ISG’s on-site work resided, saw the largest proportional increase at 289% to £1.2bn after a dip in recent months. Almost half of this value came from the £500m Gigafactory in the Southwest.

However, Barbour ABI sounded a cautious note about the future.

“Looking forward, there continue to be some key risks to growth in the construction sector; continuing materials price inflation, skills shortages and an ageing demographic of construction workers,” said Barbour ABI head of business and client analytics, Ed Griffiths. “Additionally, construction insolvencies are at their highest level since the financial crisis of 2008. Notably, this month saw Tier 1 contractor ISG fall into administration.”

“ISG’s headline-grabbing work on 69 ongoing central government projects is just the tip of the iceberg when you look at the full data set of the company’s contract portfolio. The ripple effect will be extremely worrying for the sector.”

Sector continues to grapple with new housing targets

Residential contracts were rising in September, up 14% alongside a 9% increase in approvals. However, Barbour ABI found new figures released by the Government showed the extent of the challenge ahead for meeting housing targets.

“Analysis of the government’s latest housing supply data shows starts in Q2 were down significantly compared to the same period last year, with approximately 23k starts compared to 66k in 2023,” said Griffiths. “Average completions over the past four quarters would add up to around 812k homes over five years should current levels continue. Well short of the 1.5m target set by the Government for this parliamentary period.”

[edit] Planning approvals are up

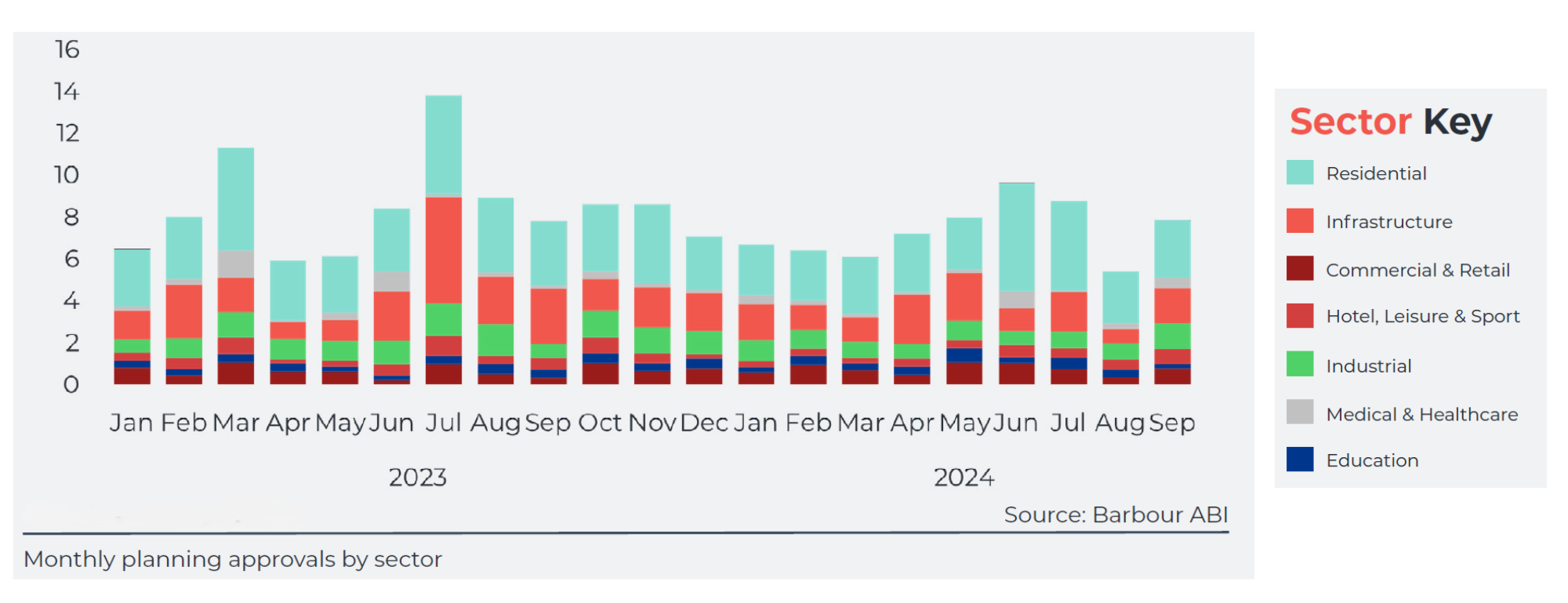

Planning approvals increased by 44% in September to £7.9bn, following a disappointing August.

Infrastructure saw the largest gain of 136% to £1.7bn, its highest month since October 2023. Highlights included 700MW and 1000MW Battery Storage Projects in Scotland and the North East respectively.

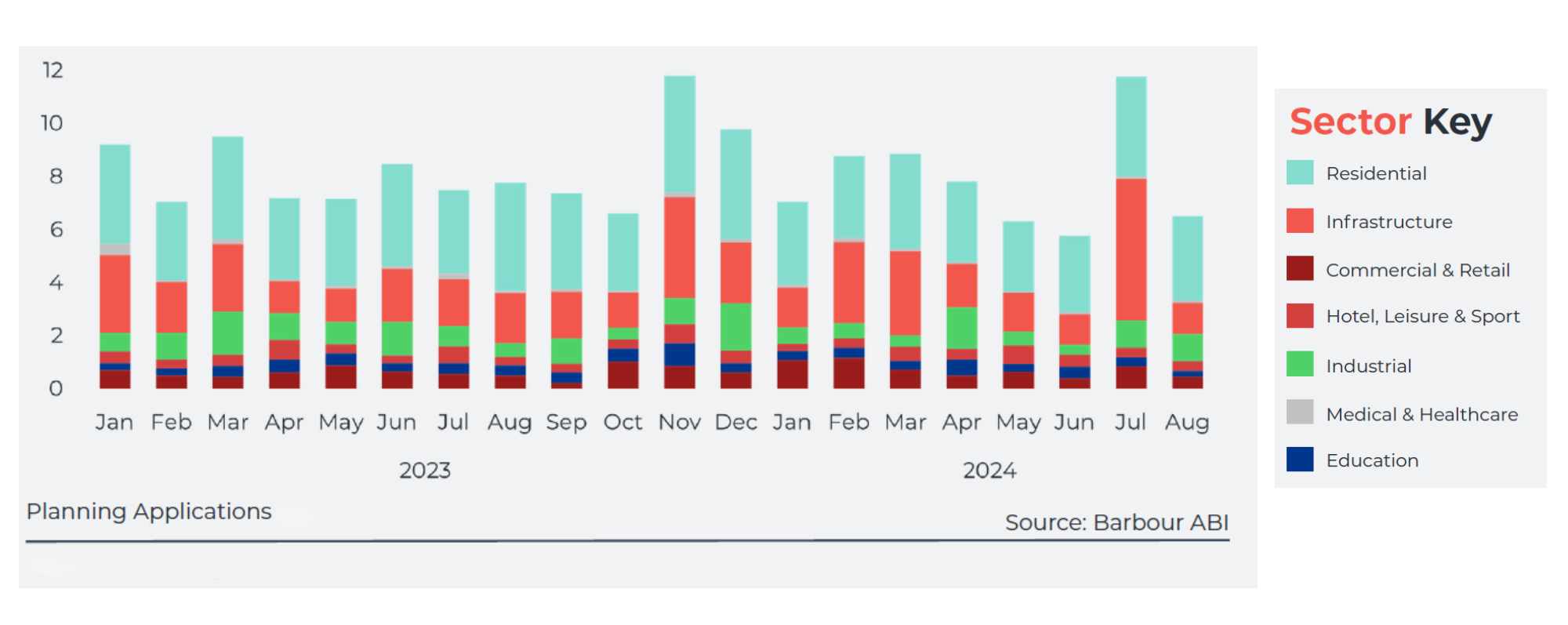

While application values for August were low, falling 45% to a total of £6.5bn, the decrease was made more dramatic by a high July boosted by large energy projects. This is shown by a monthly decrease of 78% in Infrastructure.

Griffiths added: “Planning figures returned to a more normal trajectory in August following a bumper July. This will be a key area to watch going forward to see if the ISG collapse has affected overall market appetite for new projects.”

--Barbour ABI 13:42, 09 Oct 2024 (BST)

[edit] Related articles on Designing Buildings

- Budget.

- Business model.

- Campaign for cash retentions reform.

- Cash flow statement.

- Contract claims.

- Capital costs for construction projects.

- Cash flow in construction.

- Compliance.

- Construction manager.

- Construction organisation design.

- Construction organisations and strategy.

- Corporate finance.

- Election fails to spark construction industry revival.

- Insolvency Act 1986 - Use of Prohibited Names.

- Insolvency in the construction industry.

- Insourcing.

- ISG administration, October support update.

- ISG files for administration.

- Joint venture.

- Liens.

- London construction cools as hotspots appear nationally.

- Planning approvals increased by 20% in June ahead of Labour’s new drive for housebuilding

- Profitability.

- Resolution planning.

- Site administrator.

- Solvency.

- Subcontractor.

- Support for ISG contractors, companies and employees.

- Succession planning.

- Types of construction organisation.

- Vested outsourcing.

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

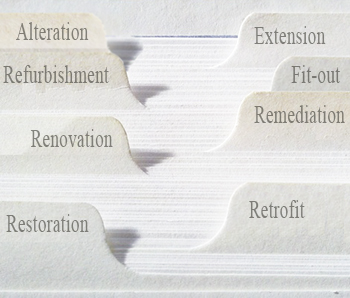

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.